1,000,000+ INVESTMENTS • 1,000+ COMPANIES LAUNCHED • $1+ BILLION RAISED BY OUR ISSUERS

YOUR CAPITAL RAISE

LAUNCH PAD

Since 2005, we have enabled some of the world’s most innovative Reg A+, CF, and D issuers to seamlessly raise capital online.

DALMORE GET'S RESULTS

AWARD-WINNING TECHNOLOGY,

BROKER DEALER AND LEADERSHIP

Cutting-edge technology

Dalmore has cutting-edge technology that enables issuers to take charge of their own capital raises with ease and confidence.

Customized Strategy

A single fundraising strategy doesn’t work for all issuers. Dalmore offers customization. Every company has a unique path to success. Dalmore helps you get there.

proven expertise

Dalmore’s team has launched more than 1,000+ companies, and its FINRA/SEC registered team has overseen more than 1,000,000 investments and counting.

THE PRIVATE CAPITAL GAME HAS CHANGED

A FULLY INTEGRATED CAPITAL RAISE PLATFORM

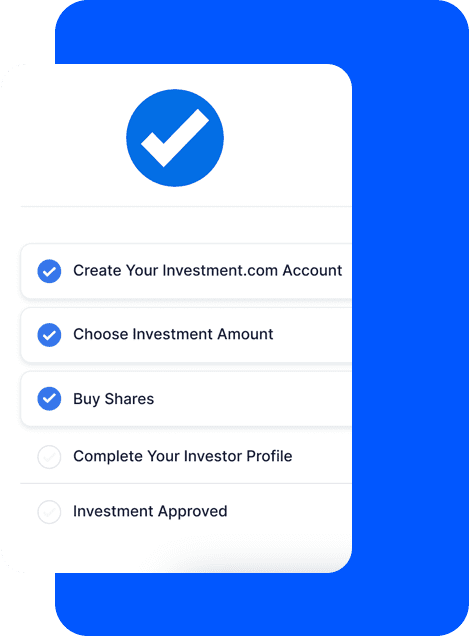

Next-Gen Web & App Platform Technologies

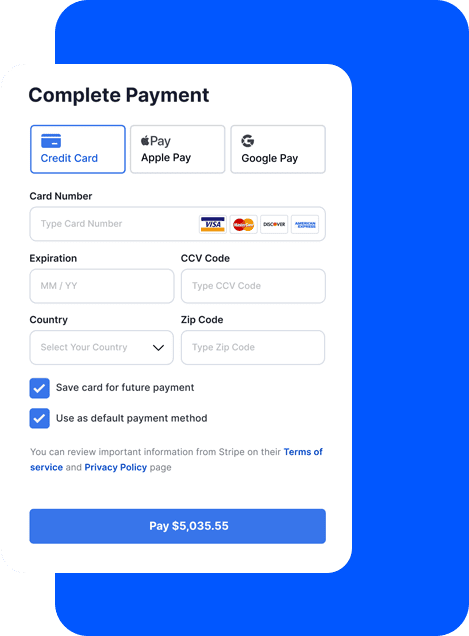

Dalmore’s technology offers Issuers a clear, compliant and efficient solution for fund raising activity. And It does so at a fraction of the cost of the competition.

Dalmore’s cutting-edge platform has revolutionized the fundraising landscape by enhancing ease of issuer entry into the process and regulatory compliance, amplifying investor engagement and minimizing cost.

Full Stack Compliance Broker Dealer Solutions

Dalmore’s solution offers a hassle-free, carefully crafted compliance process for those seeking to raise capital.

From automated due diligence and real-time verification to KYC/AML management and regulatory reporting, Dalmore has got you covered.

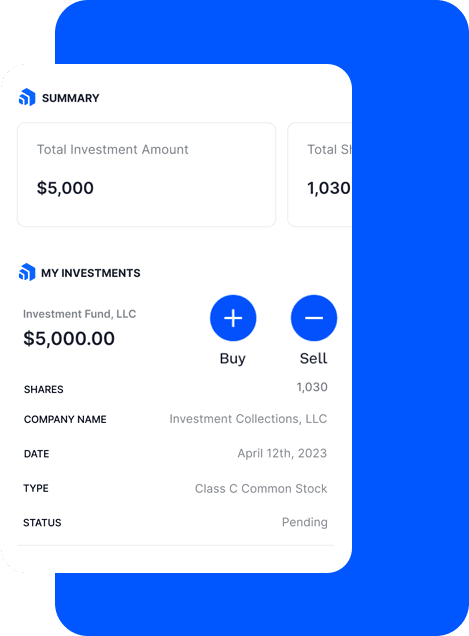

Investor Dashboard and Transfer Agent Services

Elevate your investor relations with Dalmore’s Dashboard, CRM, and Transfer Agent — a state-of-the-art experience that allows investors to monitor their portfolio performance, access relevant documents and receive critical updates.

With automated shareholder updates, dividend management, and comprehensive reporting, Dalmore’s transfer agent solution simplifies complex processes, while freeing up valuable time and resources.

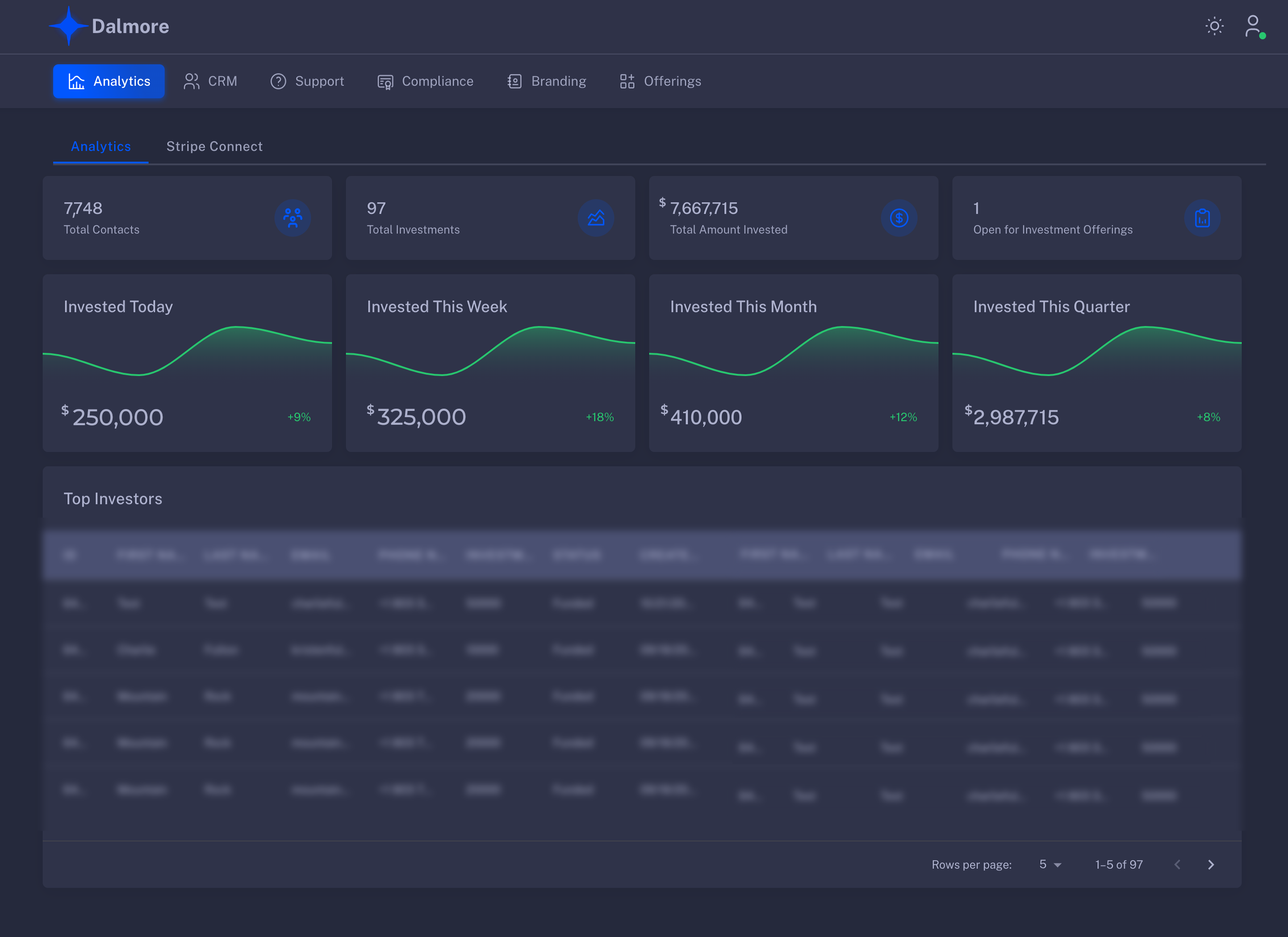

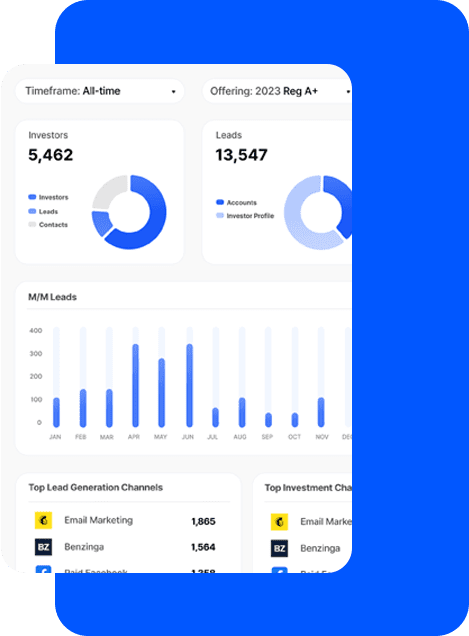

All-in-one Marketing & Advanced Analytics Suite

Unleash the power of data-driven decision-making with Dalmore’s marketing and analytics solutions, tailored for capital raise groups striving for growth and optimal performance.

Now, you can effortlessly track and analyze key performance indicators, identify emerging trends, and optimize your marketing strategies for maximum impact. Do it the Dalmore Way.

Dalmore's cutting-edge platform has revolutionized the fundraising landscape by enhancing ease of issuer entry into the process and regulatory compliance, amplifying investor engagement and minimizing cost.

From automated due diligence and real-time verification to KYC/AML management and regulatory reporting, Dalmore has got you covered.

With automated shareholder updates, dividend management, and comprehensive reporting, Dalmore's transfer agent solution simplifies complex processes, while freeing up valuable time and resources.

Now, you can effortlessly track and analyze key performance indicators, identify emerging trends, and optimize your marketing strategies for maximum impact. Do it the Dalmore Way.

FIND YOUR INVESTORS. MAKE YOUR MARK.

DALMORE'S PLATFORM IS DIFFERENT

It is easy to use, is focused on your company, allows you to take full advantage of investor interest and gives you the best value for your capital raising dollar.

🎉

You choose your investors.

You are not limited to venture capital or friends & family investors. Anyone over 18 years of age can buy shares of your offerings.

📲

Your domain or your app.

Your offering is the only one the investor will see on your site or app. You control the offering and analytics, and take full advantage of your marketing efforts.

❤️

Issuer friendly pricing.

Spend a fraction of what a third party platform will cost and benefit from Dalmore’s issuer friendly payment processing and technology fee model.

FIND YOUR INVESTORS. MAKE YOUR MARK.

DALMORE'S PLATFORM IS DIFFERENT

It is easy to use, is focused on your company, allows you to take full advantage of investor interest and gives you the best value for your capital raising dollar.

DALMORE'S ISSUER SPOTLIGHT

“We were overwhelmed with interest and Dalmore helped us close our funding round in just one week.”

Chris Anthony

CEO, Aptera

“We have worked on many successful Reg A offerings with Dalmore. It’s always easier when the broker is experienced and can get through the regulatory process fast because they understand what the regulators need. We love Dalmore’s “get it done” attitude, and the flexibility that is needed to find solutions to the issues that arise in this very new and evolving market.”

Sara Hanks

CEO, CrowdCheck

“With millions of members, Public needed a well-trodden path for our Reg A+ primary issuance and secondary trading broker-dealer partner. Dalmore’s experience, compliance infrastructure and cost-effective solutions make them the perfect fit.”

Keith Marshall

GM, Alternatives, Public

“I’ve been in community capital for over 12 years and we chose Dalmore Group as their experience in the crowdfunding industry was unparalleled. From their advanced technology and tools, to their breadth of regulatory knowledge, to their accessibility whenever we needed anything, they were definitely the right choice for us!”

Sally Outlaw

Founder, CEO - Worthy Financial, Inc.

“There are few partners you can truly trust with your own clients. Dalmore is one of them; they combine deep regulatory expertise with practical and innovative client solutions. Dalmore is a valued partner in our ecosystem.”

Rebecca Kacaba

CEO, DealMaker

“Dalmore’s track record all across the Reg A+ space makes them an ideal partner as Vint democratizes the fine wine and spirits investment market.”

Nick King

CEO and Co-founder, Vint

“The team at Dalmore has been amazing to work with, we’ve been honored to be part of their program which has worked incredibly well for businesses and investors as they’ve led many of the biggest and most successful Reg A capital raises in the industry.”

Scott Purcell

Founder & CEO, Banq

“Dalmore has become the go to firm in the Regulation A space, offering exceptional service with professional execution.”

Laura Anthony, Esq.

Founding Partner, Anthony L.G., PLLC

“Dalmore’s professionalism and ability to navigate regulatory nuances makes them a great partner for all your broker deals needs.”

Chuck Pettid

EVP, Republic

“As the first and largest issuer of collectible assets in the Reg A+ space, working with experienced partners like Dalmore has been key to our success to date. Rally chose Dalmore as a broker-dealer partner based on their deep experience and trusted reputation in the primary issuance and secondary trading of private securities.”

George Leimer

CEO, Rally

“Dalmore Group has been the ideal partner for us to raise capital via equity crowdfunding. They’ve provided the tools, processes, and relationships to allow us to raise multiple financing rounds and successfully scale our business.”

Kevin Morris

CFO, Miso Robotics

“Dalmore Group is an industry leader for a reason. They provide exceptional value, are proactive with their clients, and operate with integrity. They have been a strategic partner to my companies for years.”

Darren Marble

CO-CEO, Crush Capital | CEO, Issuance

“Dalmore Group has been a great partner to North Capital. Our collaboration has resulted in a seamless client experience, reducing the number of intermediaries and ensuring a high level of service. The Dalmore team is experienced, responsive, and solution-oriented – everything we look for in a service provider to our customers.”

Sara Judd

CFO, North Capital

“When looking into conducting our Reg A+ offering for boxabl.com I interviewed every broker dealer in the business. Dalmore stood out big time. They had a seamless process with low fees and didn’t get in our way as entrepreneurs. With their help we were able to have a record setting Reg A+ and ultimately raised over $140m through crowdfunding.”

Galiano Tiramani

Director / Founder, Boxabl

YOU HAVE CHOICES

WE HELP YOU DECIDE

FRACTIONAL ISSUERS

Dalmore has shepherded several pioneering Reg A+ fractional issuers to market – including Rally, Otis, MyRaceHorse, Collectable, Arrived, Here, Landa, Vint, Rares, CommonWealth, SongVest, FranShares, Fintor, CityFunds and many others.